Subdivide Into Financial Classes

The first step in optimizing performance of your billing department is to assign tasks by financial class—that is, assign specific tasks to each biller. This not only clearly delineates responsibilities, but it allows staff members to easily isolate problems. For example, if you have a department of eight and each has five denials on Anthem claims, individually they may not recognize a problem. However, if you one biller is assigned to post all Anthem claims and she sees all 40 denials, she will see the problem and be able to fix it and avoid significant financial disruption. Your practice can be divided into as many or as few financial classes as the size of your payer demographic permits. For larger practices, I have found that the most dominant and easily identifiable classes are as follows: Medicare; Medicaid; Anthem; HMO; Blue Shield; Other Commercial Payers; and Workers Comp. Based on you payer population, you may need to divide these classes even further, perhaps dividing Anthem by alphabet, classifying your different Medicaid carriers or dividing “Other Commercial” into groups of your larger commercial carriers.With some payers reducing filing deadlines to 90 days, it is imperative that billing departments stay current on submissions, appeals and follow-up. This is most important for drug reimbursements, as we strive to get paid in full before paying the large invoiced amounts.

The Theory of R-E-V-E-N-U-E

The old way of delineating job duties in billing departments between members who posted payments and those who worked reports provided very little quantitative accountability. We could not measure who was carrying their own weight and who was just along for the ride. So, we implemented a theory of R-E-V-E-N-U-E:

• Reports, reports, reports;

• Expand;

• Vesting;

• Expectations;

• No permissions for write-offs;

• Understanding;

• Evaluate.

Reporting

Reports are instrumental in recording and measuring financial success. When you break a practice down into financial classes, reporting becomes more manageable and much more enticing to your team. Some items will generate small reports; more comprehensive items will demand more time.

|

Expand

After you establish a baseline of each individual’s skill set, expand her responsibilities until you both feel satisfied that she’s working at maximum production. If one biller seems to complete the assigned work for her financial classes early, perhaps she can work on the “seen-and-not-billed” report, handle refund requests, reconcile the drug log or chart audit requests. Minimizing employee downtime by assigning additional tasks will not only reduce salary overhead, but also award your hard-working employees with further recognition within your practice.

Vesting

We all too often find fault within our billing departments for decreased payments, incorrect write-offs and incomplete drug reimbursements, but how often do we include billing staff in clinical successes? When drug logs are reconciled correctly, usually we applaud the scribes or techs. When the physician has a smooth day in clinic, she or he can be very complimentary to support staff.

However, far less often does a physician or administrator offer accolades to the billing team upon completion of a successful revenue-generating quarter. In some cases, physicians may not even know the names of the employees in the billing department. A little praise can go a long way.

Expectations

As leaders, we can all visualize what we expect of our team members, but often do not verbally express what our optimal outcome may look like. How can we gauge success or failure if we do not clearly define expectations at the start? More importantly, how can we hold others responsible for not meeting standards that were not clearly explained?

No Permissions for Write-Offs

Supervisors should be the only team members with the authority to permit significant write-offs beyond the standard insurance adjustments. A common practice has been to incentivize individuals based on keeping outstanding claim percentages below a target. However, if not carefully monitored and highly restricted, this can encourage unnecessary and improper claim write-offs to hit incentive goals.

Understanding

Require that each staff member have a comprehensive knowledge of reimbursement expectation for her financial class. Ask each person to prepare a fee schedule on a regular basis to ensure that she is always up to date with any changes or payer coding requests.

Evaluate

Direct the time allocated to each job function (posting, follow-up, reporting, etc.). I suggest setting the following daily time limits during implementation: one hour on the weekly report, two hours on accounts receivable and the remaining five hours on batch posting. By requesting that team members spend the same amount of time on each aspect of the job, you can properly evaluate their individual talents.

Understanding the Concept

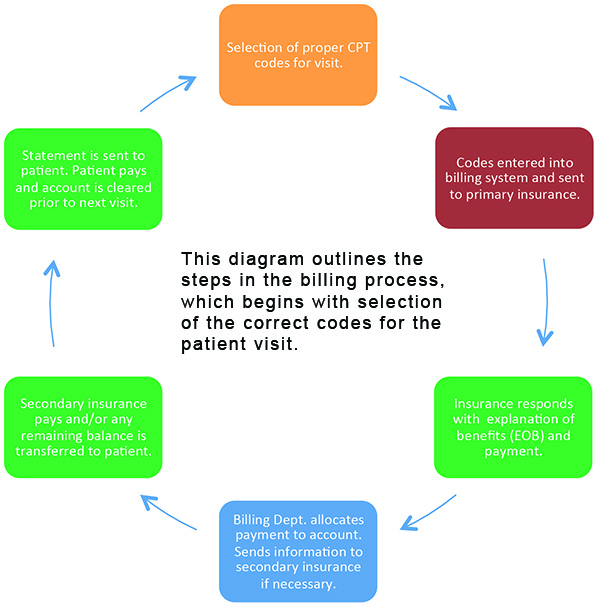

Many times throughout my career, physicians have asked me to explain the billing process because they, in their own words, “just do not understand it.” I can relate, as I feel the same way about our information technology. You could talk to me all day about T-1 lines, bandwidth, megabytes up and down, and at the end of our discussion I would still have only a vague understanding of how it all works. For the sake of this discussion, I have simplified the billing process into the steps shown in the accompanying diagram on page 37.

If your entire team understands this process, they can begin to fill in the blanks on their own, leaving management to focus on more serious payer problems.

Conclusion

To fall back on the sports metaphor, all-star teams exist for a reason: no one team has all the “best of the best.” The team that wins the championship has some outstanding players working in combination with those regarded as good, average and, all too often, mediocre. Teams that go the farthest utilize players in their best positions, not necessarily the position they want to play or the one they’ve always played.

The mantra of doing something because that’s the way you’ve always done it has become much too common in departments such as billing. That would never work with a sports team, and we would never apply that mindset to patient care. Just as the clinical standard of care is continuously evolving, so too must our revenue-generating protocol. Quantitative accountability can get you there. RS

Ms. Ratliff is chief operating officer at California Retina Consultants and Research Foundation, Santa Barbara.