|

|

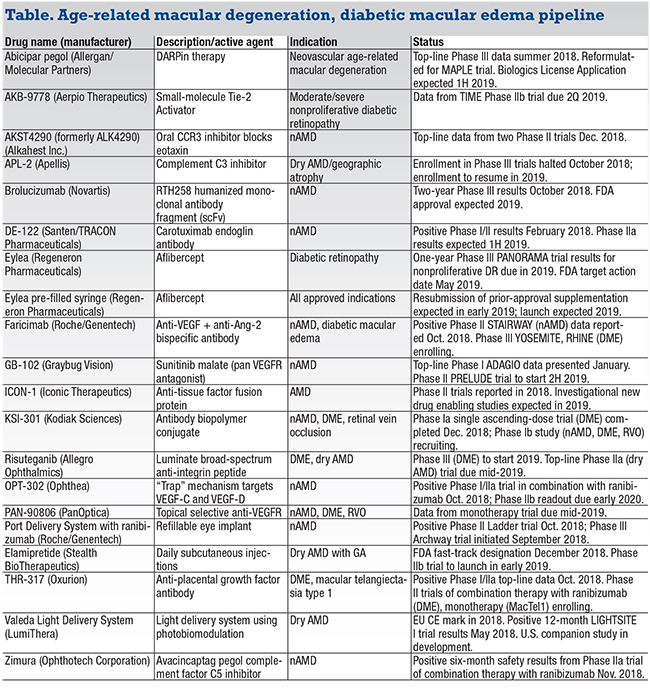

2019 is poised to be an active year for new treatments for age-related macular degeneration or diabetic macular edema, and in many cases both. Our annual listing of investigative chemical and biologic agents (and one light therapy) in Phase I trials and beyond numbers at least 20 with notable milestones ahead.

Novartis anticipates Food and Drug Administration approval for brolucizumab, which many pharmaceutical analysts say could become one of the leading drugs for neovascular AMD and DME. Regeneron anticipates two significant events this year for Eylea (aflibercept): launch of the pre filled syringe; and FDA action to add diabetic retinopathy as an indication.

A comprehensive list of drugs in development for AMD and DME is almost impossible to fit on one page (Table, page 32). Four agents have been added to the list, and four were removed. Abicipar pegol (Allergan) was omitted last year because no milestones were anticipated (turns out top-line Phase III data came out). Other new entrants are elamipretide (Stealth BioTherapeutics); KSI-301 (Kodiak Sciences); THR-317 (Ox- urion); and Valeda Light Delivery System (LumiThera). Deleted are nesvacumab (Regeneron), RG7417 (lampalizumab, Roche/ Genentech), OHR (Ohr pharmaceuticals) and X-82 (vorolanib, Tyrogenex). Their development programs were terminated. Two name changes occurred: Faricimab (Roche/Genentech) was listed as RG7716; and Luminate (Allegro Ophthalmics) now has the generic name risuteganib.

This list was compiled with the help of Editorial Board member Emmett T. Cunningham, MD, PhD, and is based on presentations at the American Academy of Ophthalmology Retina Subspecialty Day, American Society of Retina Specialists 2018, Retina Society and Ophthalmology Innovation Summit, as well as our own research and verification. A report on gene therapies will appear later in the year.

|

Abicipar pegol (Allergan/Molecular Partners)

When SEQUOIA and CEDAR trial results of abicipar for nAMD came out, some clinicians expressed concerns about reported relatively high rates of inflammation. The website Pharmaceutical Technology reported that three investigators noted the trials “may have” had cases of hemorrhagic vasculitis, but specifics of the cases were difficult to ascertain. Rates of intraocular inflammation were 15.7 percent and 15.3 percent in the eight- and 12-week abicipar groups, respectively, and 0.6 percent in the Lucentis (ranibizumab, Roche/Genentech) arm.

Both trials showed similar efficacy of abicipar after six or eight injections vs. 13 for Lucentis after a year, with similar adverse event profiles among the three treatment arms (abicipar every eight and 12 weeks, Lucentis every four weeks). The percentage of patients with stable vision ranged between 91 and 96 percent across all three treatment arms in both studies. Allergan said it would use a modified formulation for the MAPLE trial. Allergan expects to file a biologics license application with the FDA in the first half of this year.

AKB-9778 (Aerpio Pharmaceuticals)

Investigators in January completed patient dosing in the Phase IIb TIME trial of AKB-9778 for severe nonproliferative diabetic retinopathy. Administered via subcutaneous injection, AKB-9778 binds to and inhibits vascular endothelial protein tyrosine phosphatase, which negatively regulates Tie2. The TIME Phase Ia study showed improvement in diabetic retinopathy and kidney function. Top-line Phase IIb results are expected in March.

APL-2 (Apellis Pharmaceuticals)

APL-2 proves that drug development doesn’t always follow a linear path. In June 2018, the FDA granted fast-track designation to APL-2 for treatment of geographic atrophy. APL-2 is a novel inhibitor of complement factor C3 administered intravitreally. One month after initiating the Phase III DERBY and OAKS trials, Apellis voluntarily suspended them because a few patients had noninfectious inflammation from a single manufacturing lot of the product. In the Phase II FILLY trial, one case of noninfectious inflammation was reported in more than 1,500 patients dosed. Apellis says it will restart the trials in the second quarter and expects full enrollment by early 2020.

Brolucizumab (Novartis)

Novartis last year announced two-year results from the Phase III HAWK and HARRIER trials that reaffirmed positive one-year findings. This small-molecule, single-chain antibody fragment clears more rapidly from the circulatory system than larger-molecule agents. In a head-to-head study of nAMD patients, HAWK and HARRIER findings demonstrated that fewer patients had intraretinal fluid (IRF) and/or subretinal fluid (SRF) with brolucizumab 6 mg vs. Eylea at 96 weeks (24 vs. 37 percent in HAWK [p=0.0001], and 24 vs. 39 percent, respectively, in HARRIER [p<0.0001]).

Other key findings: absolute reductions in CST from baseline were -175 μm for brolucizumab 6 mg vs. -149 μm for Eylea (HAWK, p=0.0057) and -198 μm vs. -155 μm, respectively (HARRIER, p<0.0001). Eighty-two percent of brolucizumab 6 mg patients who successfully completed one year on 12-week dosing in HAWK and 75 percent in HARRIER were still on 12-week dosing in the second year. Novartis says it expects FDA approval for nAMD in 2019.

DE-122 (carotuximab, Santen)

Top-line Phase I/II results of DE-122 for refractory wet AMD presented last year at the Annual Angiogenesis, Exudation, and Degeneration symposium reported no serious adverse events and suggested bioactivity, as measured by mean change in CST. The Phase IIa trial is evaluating intravitreal injections in combination with Lucentis vs. Lucentis monotherapy, with results expected in the first half of 2019. Carotuximab is a novel antibody to endoglin, a protein overexpressed on endothelium essential for angiogenesis and upregulated by anti-VEGF.

|

Elemipretide (Stealth BioTherapeutics)

The FDA in December 2018 granted Stealth BioTherapeutics fast-track designation for elamipretide for treatment of dry AMD with geographic atrophy via daily subcutaneous injection over 24 weeks. A Phase IIb trial is scheduled to begin early this year. The FDA also granted fast-track designation to elamipretide for treatment of primary mitochondrial myopathy, Barth syndrome and Leber’s hereditary optic neuropathy.

Eylea (aflibercept, Regeneron)

Last year, the FDA approved a modified 12-week dosing schedule for Eylea in patients with nAMD. This year, Regeneron expects to launch the Eylea prefilled syringe.

Regeneron also reported at AAO 2018 that the Phase III PANORAMA trial in patients with moderately severe and severe non-proliferative diabetic retinopathy met its one-year endpoint: 80 percent and 65 percent of patients on every eight- and 16 week dosing (after an initial monthly dosing period), respectively, had a two-step or greater improvement on the Diabetic Retinopathy Severity Scale vs. 15 percent receiving sham injection (p<0.0001). The FDA has assigned an action date in May for this indication.

A separate ongoing trial by the Diabet- ic Retinopathy Clinical Research Network, known as Protocol W, is evaluating Eylea for treatment of NPDR in patients without DME. At the J.P. Morgan Healthcare Con- ference in January, Regeneron disclosed that it expects to enter clinical trials this year with a high-dose formulation of Eylea.

|

Faricimab (Roche/Genentech)

This novel small-molecule, bispecific antibody for nAMD was the subject of positive results from the Phase II STAIRWAY trial reported at AAO 2018. The trial evaluated outcomes of faricimab 6 mg dosed every 16 or 12 weeks after four loading doses and Lucentis 0.5 mg every four weeks. At 24 weeks, after the loading doses, those in the 16-week dosing group had a mean improvement of 11.4 chart letters vs. 10.1 letters for the 12-week group and 9.6 letters in the Lucentis group. Formerly known as RG7716, faricimab simultaneously binds to and neutralizes both angiopoietin-2 and vascular endothelial growth factor A. The Phase III RHINE and YOSEMITE studies in DME, and the PHASE III STAIRWAY study in nAMD are expected to start enrollment this year.

GB-102 (sunitinib, Graybug Vision)

GB-102 is an injectable formulation of sunitinib, a tyrosine kinase inhibitor that blocks multiple VEGFR pathways. The goal is to reduce injection burden to once or twice a year. Results of the ADAGIO Phase I/IIa study of GB-102 in patients with wet AMD, which David S. Boyer, MD, reported at the 2019 Hawaiian Eye & Retina meeting, showed GB-102 was well-tolerated with no dose-limiting toxicities, drug-related serious adverse events or inflammation, and 88 percent and 68 percent of patients were maintained only on a single dose of GB-102 at three and six months, respectively. The Phase IIb PRELUDE trial is expected to begin enrollment in the first half of this year.

ICON-1 (Iconic Therapeutics)

This first-generation tissue factor antagonist demonstrated target engagement, biologic activity and the ability to impact important clinical endpoints in the Phase II EMERGE trial, reports Iconic Therapeutics. A second Phase II trial, known as DECO (for Dose Exploration and Continuation Option), started enrollment in May 2018, recruiting patients with choroidal neovascularization secondary to AMD. Iconic last year initiated a Phase II trial of intravitreal ICON-1 both in combination with Eylea and after Eylea in patients with nAMD.

KSI-301 (Kodiak Sciences)

KSI-301 is a completely new anti-VEGF antibody biopolymer conjugate. Twelve-week data from a Phase Ia single ascending-dose study showed a clinical response in eight of nine patients with severe DME. Pooled data across three dosing levels showed median improvements of 9 letters in best-corrected visual acuity and 121 μm in central retinal thickness. The 5-mg dose will be the subject of pivotal studies in severe DME. A Phase II comparison study with Eylea is on track to begin enrollment in the second quarter this year.

OPT-302 (Opthea)

This intravitreal agent inhibits vascular endothelial growth factors C and D. A Phase I/IIa trial is evaluating OPT-302 in combination with Lucentis for nAMD. At 12 weeks, treatment-naïve patients (n=18) had a more robust improvement in BCVA (+10.8 vs. +4.9 letters) and CST (–119 μm vs. –54 μm) than prior-treatment patients (n=20). The Phase Ib dose-escalation DME study evaluated OPT-302 in combination with Eylea, and found a dose-related response to gains in visual acuity and retinal inflammation.

PAN-90806 (PanOptica)

The company describes this as a topical, selective, small-molecule anti-VEGF agent. Last May PanOptica initiated a Phase I/II dose-ranging trial of 60 patients with nAMD. Trial subjects will use the drop daily for three months. The study is due for completion in the first half of 2019.

|

Port Delivery System with ranibizumab (Roche/Genentech)

This refillable implant, known as PDS, serves as a micro-reservoir of sorts. It is surgically placed in the pars plana to provide a continuous release of ranibizumab. The aim is to go six months between refills. Top line results in 2018 showed that 80 percent of patients in the 100-mg/ml high-dose group went six months between refills and achieved similar visual outcomes as the ranibizumab 0.5-mg group dosed every four weeks. Based on those results, Genentech initiated the Phase III Archway trial in September 2018 to evaluate the PDS 100 mg/mL concentration in patients with nAMD on a fixed dosing interval of 24 weeks compared to monthly ranibizumab 0.5 mg. The estimated completion date of the trial is May 2022.

Risuteganib (Luminate, Allegro Ophthalmics)

Allegro adopted the generic drug name risuteganib for Luminate and anticipates starting a Phase III DME trial in the first half of 2019. Risuteganib targets all four oxidative stress pathways in DME: increased vascular permeability; angiogenesis; inflammation and cell death; and neurodegeneration. The Phase IIb DEL MAR trial demonstrated that risuteganib monotherapy and sequential therapy were non-inferior to bevacizumab (Avastin, Roche/Genentech), being most effective in patients with persistent active DME and a history of anti-VEGF treatments. The Phase III trial will adhere closely to what worked well in the Phase IIb DEL MAR trial. Top-line Phase IIa results in dry AMD are also due mid-year.

THR-317-001 (Oxurion)

Oxurion is pursuing three clinical programs in DME with its lead candidate, THR- 317-001, which utilizes placental growth factor. Positive top-line 90- and 150-day data on safety and clinical activity from a Phase I/IIa trial in DME were reported last year. Also enrolling are Phase II trials in combination with Lucentis for DME and monotherapy for macular telangiectasia. Oxurion has two other programs targeting novel pathways in DME: THR-149, a plasma kallikrein inhibitor; and THR-687, an integrin antagonist.

Valeda Light Delivery System (LumiThera)

Valeda employs a process called photobiomodulation to apply a series of light-based treatments to retinal cells, with the aim of improving energy production and addressing inflammation, ischemia and metabolic dysfunction. The system was granted CE (European conformity) in June 2018. Updated results from LIGHTSITE I showed 50 percent of treated eyes (n=15 patients) achieved >5-letter gain a month after treatment, with retreatment needed at six-month intervals. LumiThera has ongoing multicenter studies in Europe and is developing a companion study in the United States.

Zimura (avacincaptad pegol, Ophthotech)

Despite positive Phase IIa trial results of this complement factor C5 inhibitor in combination with Lucentis for nAMD, Ophthotech Chief Medical Officer Kourous Rezaei, MD, said the company would shift focus to other Zimura programs in geographic atrophy secondary to dry AMD and autosomal recessive Stargardt’s disease. RS