With the advent of high cost FDA-approved injectable and implantable pharmaceuticals, and with more on the way, the protocol for managing cash and the related drug inventories must change to ensure adequate cash is available to meet ongoing operating expenses and drug inventory purchases.

To handle the high volume of drug purchases, the typical practice uses a high-limit credit card. These cards have varying terms, of course, but most offer a grace period for payment with no penalty or interest ranging anywhere from seven to 30 days. Online account access lets you readily see future payment obligations and due dates.

A Sword With Two Edges

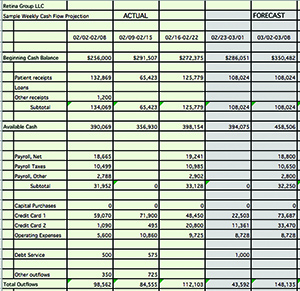

Complicating this process are the various deferred payment terms the drug manufacturers offer. Depending on the drug, these can range from 30 to more than 100 days. Like any credit scenario, this is a two-edged sword. The lengthy payment terms give the practice the opportunity to use most of its drug inventory before the payment due dates. On the other hand, if the practice does not place controls on cash management, there might not be enough money on hand when the credit card is due.To ensure this dilemma never arises, the retina practice needs some basic cash forecasting tools. Best practices suggest a weekly projection of cash inflows and outflows for at least three months, although a full-year projection is best. Historical patient volumes and related reimbursements offer the best source for projecting future incomes.

Payroll and payables are easy to account for by reviewing historical financial statements and by breaking down the monthly expenses by week based on invoice-due dates. Drug purchases or, more importantly, the charge date (assuming they’re credit card purchase), can be identified by reviewing purchase reports from manufacturers and/or distributors.

Combining these three elements—reimbursement inflows, operating expense outflows and drug purchase payment dates—gives the details you need to forecast cash. Of course, capital purchases and any related debt-service payments must also be considered. However, these transactions are generally planned in advance and can be incorporated into the cash forecast as the group makes purchase approvals.

Bringing Pieces Together

Given the fragmented sources of this critical information, an Excel spreadsheet or something similar can bring all these pieces together so that you can know each week’s cash position and plan for it well in advance. Like any forecast, the numbers are only as good as the data entered.Accordingly, the forecast should be updated at least weekly to remain current as well as provide as much advance notice as possible of any potential “tight” weeks that may lie ahead. I provide an example of just

a few weeks of such a spreadsheet or reference.

By updating forecast data to actual numbers over time, the forecast will incorporate prior cash flow into predicted cash flow. With a vigilant eye on the numbers, the practice should find itself in the position to reduce (and hopefully eliminate) any guesswork surrounding cash management. RS

Mr. Laurita is administrator at Retina Associates of Cleveland Inc. in Ohio.

Mr. Lucas is CFO and administrator of Georgia Retina PC, Atlanta.